Yes! You can earn over 100,000 APY by just staking cryptocurrencies. The crazier part is that this number was around 200k APY just a few months ago. Before you think that I am just spitting random crazy numbers at you, I am going to explain to you how all this is possible, how you can earn these crazy rates, and obviously, what could go wrong.

When I first found out about this, I was very skeptical and simply ignored the project for weeks. My friend told me about it and he himself didn’t understand how it properly functions, so it seemed to me like a Ponzi scheme. But Olympus stood for months and many of its forks like Time wonderland were becoming popular. So, I thought of putting some money into these projects and then started learning about them.

What’s a better motivator to learn than your own money.

Before we go ahead, I would like to disclose that I have personally used these platforms but I am not affiliated or sponsored by any of them in any form. This article is based on my understanding of Olympus and how it works, please share your thought so that I can refine mine.

Here’s what you will learn from this article -

- What is DeFi

- DeFi 1.0 (Liquidity Mining)

- Problems with DeFi 1.0

- Enter DeFi 2.0

- How Olympus works

- APY is an illusion

What is DeFi

In case you haven’t heard of DeFi, it stands for Decentralized Finance.

DeFi is an attempt to replicate and enhance the current system of finance and the way we interact and use our money

DeFi, unlike traditional finance, is trying to create a platform that is more accessible to anyone. This accessibility includes not only basic financial services such as lending, borrowing, investing, etc but provides anyone with the ability to create their own financial products and solutions.

In theory, DeFi would provide anyone with an internet connection, access to lending, borrowing, investing, plus the ability to create financial products, and improve/contribute to existing financial solutions, regardless of their demographics, income, or other factors.

Contrary to this definition, most of the DeFi protocols are controlled by a few individuals and are not actually Decentralized Autonomous Organizations (DAOs). However, most of these protocols aspire to be DAOs in the future. Initially, it is hard for any organization to become DAOs because of management, incentivization, and logistic difficulties. In my opinion, a true DeFi protocol should be a DAO.

DeFi 1.0 (Liquidity Mining)

One of the most basic functions of an asset is to be able to trade for another asset. To facilitate this trade, we need a middleman or a protocol that oversees and executes this transaction.

In a traditional setting, this is done by Centralized Exchanges (CEXs) which is an organization registered in a nation, controlled by a few board members and lives on a central server. Centralized exchanges maintain liquidity of certain assets they want their users to be able to trade and charge a transaction fee to the user to make this trade.

I won’t go into details about how centralized exchanges work but if you are interested in it, you can check out an article written by —

Let’s head over to the decentralized world again, shall we?

In the decentralized world, there is no central authority with liquidity. To access liquidity, these platforms provide users with incentives in the form of transaction fees and free tokens proportional to the provided liquidity. This is also known as liquidity mining or farming. The liquidity is usually provided in the pairs of two tokens ex ETH/USDT in a 50/50 ratio. The received tokens are called LP tokens.

Here’s a more detailed article on how to make money with DeFi 1.0 —

Problems with DeFi 1.0

To incentivize people to provide liquidity, DeXs introduced the concept of farming but there are several problems with that concept.

- If the platform stops providing lucrative LP tokens, the protocols might lose a lot of their liquidity.

- Liquidity providers often sell the LP tokens thus influencing the price of the token and making the platform less lucrative.

- Sudden price movements of assets can reduce the platform’s inventory value.

- When the users deposit a pair of assets, they are exposed to the price volatility of both of them. Thus, price movements can lead to impermanent loss and this loss is realized when users take out their stake.

- Smart contract bugs can lead to huge losses. (True for any Dapp)

In short, DeFi 1.0 attracts yield farmers who just want high APY, and once that APY is not sustainable, they dump the tokens for profit. Thus the whole protocol has a time limit and is therefore not sustainable. Let’s look at what DeFi 2.0 brings to the table.

Enter DeFi 2.0

Just to be clear there is no textbook distinction between DeFi 1.0 and DeFi 2.0, people on twitter just started referring to Olympus DAO and it’s alternatives as DeFi 2.0.

DeFi 2.0 introduced the concept of protocols owning their own liquidity. Let’s break it down.

So in the DeFi 1.0 mechanism, protocols needed a way to distribute their LP tokens thus they would offer high APYs initially and attract liquidity providers who would stick as long as that APYs last. In the DeFi 2.0 system, there are incentive mechanisms that allow the protocol to own its liquidity and thus never run out of it like DeFi 1.0 protocols.

First, let’s start with what is Olympus and what it is trying to achieve.

Olympus is a algorithmic decentralized protocol that wishes to become a reserve currency of the world. To achieve this, it created a token called OHM which in the long term should be a stable floating currency backed by other assets, much like money was backed by gold.

How does it do it?

How Olympus works

There are 3 key components that make all this possible- Bonding, Treasury, and Staking.

Treasury

OHM is backed by assets such as Ethereum, DAI, Frax, etc in its treasury. This treasury consists of stable coin and non-stable coin assets which makes the risk-free value of treasury assets. The current treasury market values/market cap is 0.25 or 25%. The minimum value of an OHM is the value of treasury/supply of OHM. The current prize of OHM is $326.76 and backing per OHM is $96.02, thus OHM is currently valued at 3.4x its backed value.

But the new OHM is minted and backed by stable coins thus the reserve treasury backing per OHM is currently $64.4. If the value of OHM goes below this price, the protocol will burn OHM or buy more treasury assets. Thus OHM will always be ≥ value in reserve treasury assets.

Bonding

Bonding is essentially similar to the bonds you get from the federal reserve. Olympus provides you OHM tokens for cheaper than the market price, i.e what it is selling on DEXs. Currently, there are two bonds available- Frax bond (5.97%) and OHM-Frax LP (0.47%) So over the lockup period of 5 days, you will unlock certain OHM tokens, proportional to your position.

In Time Wonderland, you can even claim and stake the minted tokens every 8 hours to attain the highest yield possible.

The amount of OHM that would be received by the bonder is determined by a simple equation.

Bond payout = mkt value of an asset or LP token / bond price

You can think of bond price as the value that the protocol thinks OHM is worth. Use the link for details.

This bonding mechanism works as a profit mechanism for the protocol and allows it to buy its own liquidity from the market. Thus, the protocol makes money from the sale of these bonds and through transaction fees accumulated through transactions. Olympus DAO has made over $28.8M in LP fees alone.

But there is a catch. The supply of OHM is not capped! What does this mean, you ask?

When you purchase OHM bonds, you are getting OHM for a cheaper price than market value but the lockup period is 5 days. If the price of OHM increases or remains the same you are at no loss but if it decreases, you incur a loss. If you hold the token, you again incur the loss as the supply just increases because other participants are minting new tokens. So to be profitable you can either sell the tokens as soon as you mint them or stake them.

Staking In staking, users stake the OHM token which removes those tokens from the circulation, and in return, the platform awards these users with staking rewards. Rebase is the amount of sOHM you receive after an epoch (8hrs) As of this writing, TIME is currently offering 0.5928% reward per epoch and Olympus is offering 0.3771%. This means that 5 day reward i.e 15 epochs is around 8.892% and 5.65% respectively. The APY number is the annualized return rate that is derived from this rebase reward.

So far in the history of Olympus DAO, the average OHM staked has been over 90%. This is the case because it does not matter how many OHM tokens you have, but the percent of the market cap you own. This is because the market cap of OHM might keep increasing with the circulating supply but the tokens you own will be constant if you don’t stake them.

APY is an illusion

Remember that there are two groups involved — bonders and stakers, and they both are trying to capture as much market cap of Olympus as possible.

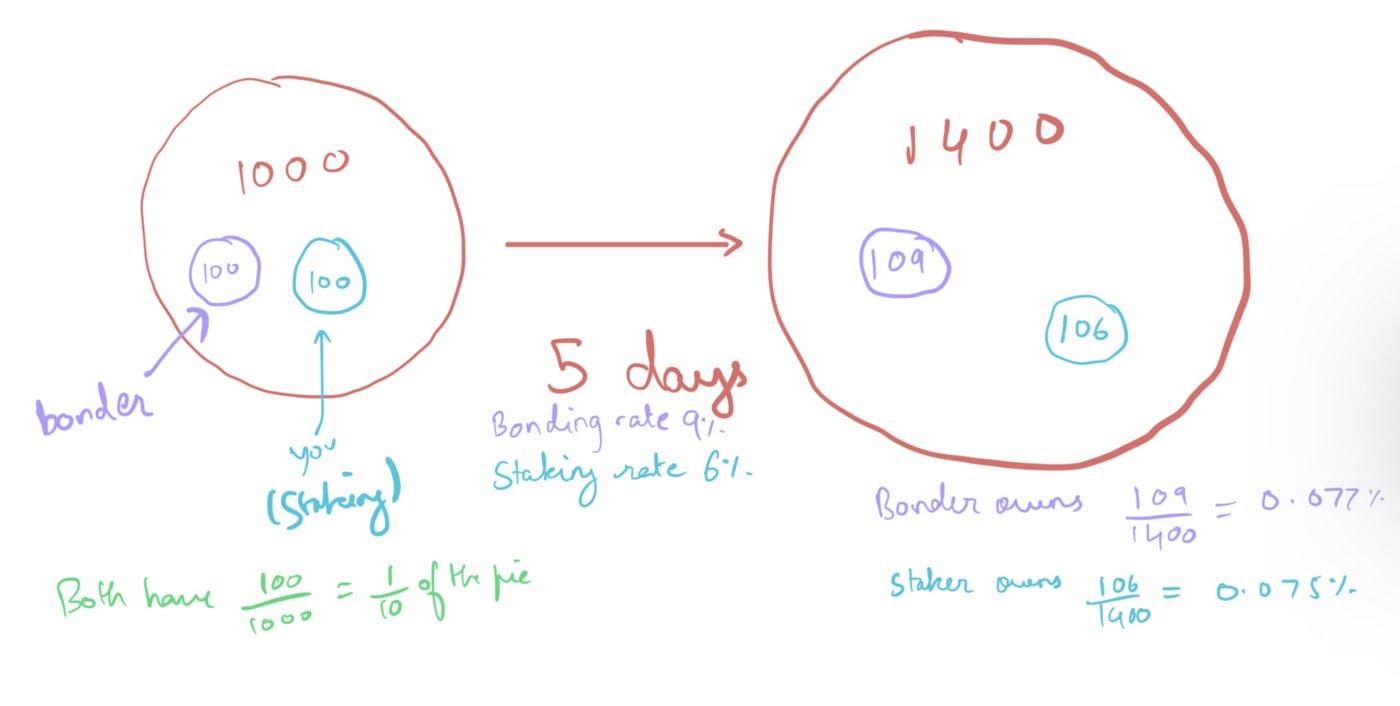

Let’s say that the size of the pie is 1000 and you enter here and own around 100 units of this pie with a random guy who has the same amount. Now to grow your share of the pie, you either stake or bond. Looking at the crazy 85,000% APY, you decide to stake and the other guy is bonding.

If the bonding rate is higher than staking, bonders are growing their piece of the pie faster than the stakers and vice versa. So in this situation, one party would benefit more than the other. For a 100k APY, the 5 day ROI would be

x⁷³=1000 , where x is the 5 day ROI, 73 is the number of 5-day epochs.

This means x = 1.09925 or 9.92%. For simplicity’s sake, let’s say that 5 day ROI is 6% i.e 7k APY for staking, and the bonding rate is 9%. It’s a no-brainer that Bonders would capture more of the growing pie. This means that the high APY that these protocols including Olympus or Time Wonderland offer does not mean much because of dilution.

Now you might be saying- but Bonding doesn’t always offer a higher APY! It’s usually less than staking.

This is true. It’s very rare for the bonding rate to be higher than staking but it’s not that it’s not possible. But even if the bonding rate is lower, you can make more money by bonding! Here’s how-

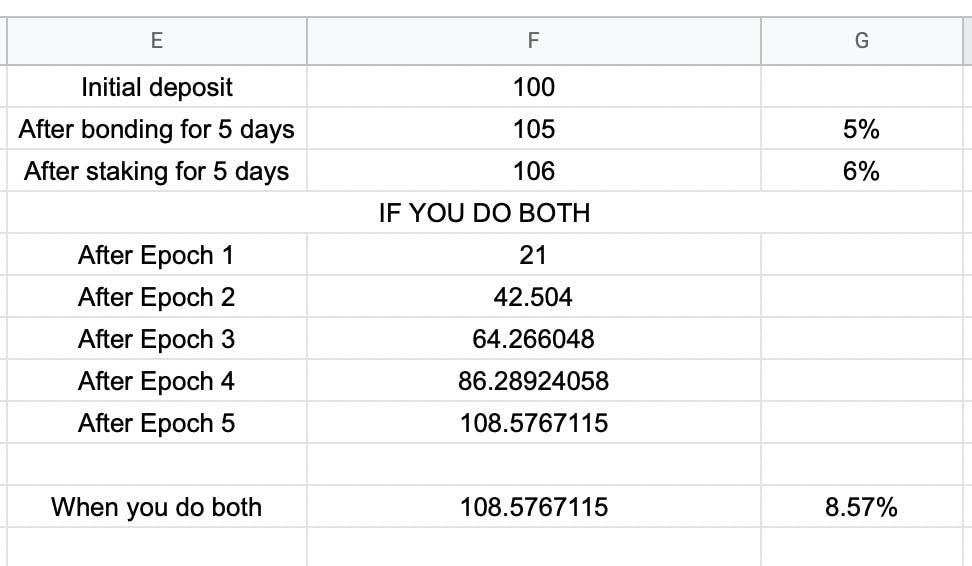

Let’s say that the bonding rate is 5% and staking is 6% for 5 days. At each epoch, you would get 5/15 = 0.33% for bonding and 6/15 = 0.4% for staking. The vesting period for bonding is 5 days but you can claim the rewards every epoch i.e 8 hours, and you can stake these back! Let’s say you claim these rewards every day and stake them back, if we do the calculation, we get —

As you can see we get an 8.57% return which is greater than both staking and bonding individually! Now claiming and re-staking involves a gas fee so if you do this in Olympus, it might not be feasible because of the Ethereum gas fee. But you can do this in Time Wonderland and earn more rewards.